Pubblicato :28/11/2022 07:38:37

Fare clic su Conteggio:2103

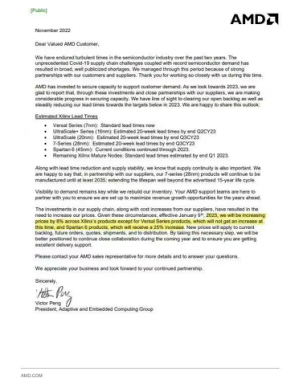

Recently, AMD sent an internal letter to supply chain customers, announcing that it will increase the price of FPGA products under its Xilinx brand. In terms of price increases, the lowest is 8% and the highest is 25%. Currently, the news has been confirmed by AMD authorized distributors.

Online AMD price increase letter

At the beginning of the third quarter, the industry has also reported that Intel has increased the price of its FPGA products, and the price increase of the older part number is 20%.

Price increases by TOP 2 manufacturers have a big impact on the market

According to AMD's price increase letter, starting from January 9, 2023, the price of the Spartan 6 series will increase by 25%, the price of the Versal series will remain unchanged, and all other Xilinx products will increase by 8%.

At the same time, AMD has also made adjustments in terms of delivery. The specific delivery date is changed to 20 weeks for 16nm UltraScale+ series, 20nm UltraScale series, and 28nm 7 series FPGA products, but it is expected to be Q2 or Q3 in 2023; 45nm Spartan 6 series maintains the current state, 7nm Versal series and other products maintain standard lead times.

Previously, Intel's price increase was 20% for older series, including Arria II, Cyclone Cyclone II, Cyclone III, MAX II, Stratix III, Stratix IV, Stratix V, EPCQ-A, etc.; newer series The price is increased by 10%. These series are mainly Arria V, Arria 10, Cyclone IV, Cyclone V, Cyclone 10, MAX V, MAX 10, eASIC, etc.

From a market perspective, both AMD and Intel's announcement of price increases will have a relatively large impact on downstream terminal manufacturers. At present, the oligopoly in the FPGA market is obvious. According to the statistics of the research institution Market Research Future (MRFR), 83% of the global FPGA market share in 2020 is in the hands of AMD (then Xilinx) and Intel, of which Xilinx China's market share is about 50%, and Intel's market share is about 33%. If the combined 13% market share of Lattice and MicroChip is added, the market share of the four international giants exceeds 96%.

In the domestic FPGA market, although some domestic FPGA manufacturers have emerged in recent years, the national giants still dominate the market. Relevant statistics show that in the domestic FPGA market in 2020, AMD (then still Xilinx) accounted for 36.6%, Intel accounted for 25.3%, Lattice accounted for 23.2%, and MicroChip accounted for 14.9% of the others. leading position.

Therefore, purely from the perspective of market share, the price increases of AMD and Intel will bring great cost pressure to equipment manufacturers.

At the same time, in the high-end FPGA market, except for AMD's Versal series, other high-end FPGAs have basically increased in price, and there are no other alternatives in the market. Of course, the price of AMD’s Versal series has always been relatively expensive in the FPGA market, basically tens of thousands of yuan, some of which can reach tens of thousands or hundreds of thousands of yuan, and the supply is also tight. Distributors The platform shows that the production cycle of these devices is 52 weeks.

Let’s talk about other high-end FPGAs. At present, the latest progress of domestic FPGA manufacturers on the 28nm node is basically small batch mass production, and the products are mainly aimed at the low-end market and low-power market of the 28nm process. Most of them are FPGAs with a gate level of about 10 million. , It is difficult to have an impact on the mid-to-high-end products of the two major companies.

28nm is a threshold for domestic FPGAs. For the market leader AMD, some of its 28nm products have been launched for more than 10 years, and there were even rumors of discontinuation of production. However, after AMD completed its acquisition of Xilinx, the company extended the life cycle of the 7 series products, including Spartan-7, Artix-7 FPGA, Zynq-7000 SoC, Kintex-7 and Virtex-7 FPGA, and will at least Extended to 2035. This has led to the fact that domestic cutting-edge FPGA products must compete with such mature products if they want to occupy the market, which is a huge challenge. Therefore, this has led to cutting-edge FPGA markets such as 5G, artificial intelligence, big data, and autonomous driving, which can only "swallow their breath" for price increases, because most devices are irreplaceable。

The FPGA demand gap is widening

Of course, whether it is AMD or Intel, the price increase of FPGA products by the two giants is not a reckless act after resource monopoly, but is driven by market factors behind it.

AMD stated in the letter that an important reason for this increase in the price of FPGA devices is the need to increase investment in the existing supply chain, while supplier price increases are also another reason. Intel's price increase rumors at the time also pointed out that the price increase was due to supply chain cost pressure and continued strong demand.

For FPGA, a more obvious cost increase is due to the price increase of the foundry. Of course, Intel is due to the increase in the price of raw materials in its own factory, such as wafers. In fact, these cost increases have already given a signal at the end of last year. For example, UMC mentioned in a price increase statement that in 2022, the price of the 8-inch wafer process will increase by 5%, and the 12-inch wafer process will increase by 5% to 10%. TSMC was pointed out at the beginning of the year that it would increase the price of 8-inch and 12-inch processes by 10% to 20%. In fact, due to logistics costs and wafer material price increases, IDMs and wafer foundries will increase prices in 2022, which must include Intel.

Looking at the demand side, according to the statistics of Susquehanna Financial Group, the delivery period of mainstream FPGAs in the market has reached the maximum value within the upper limit of 52 weeks. This author also mentioned above, the labeling of mainstream FPGA products on distributor websites , It is true that the production cycle is 52 weeks. Susquehanna analyst Chris Rolland pointed out in the report that the FPGA shortage is mainly affecting networking, optical and telecommunications equipment.

From a technical point of view, the factors behind the surge in FPGA demand are 5G and AI. If it comes to the market level, it is automobiles, data centers, 5G communications and industry. According to statistics from Frost & Sullivan, the global FPGA chip market size will be approximately US$6.86 billion in 2021, a year-on-year increase of 12.8%. Don't look at the fact that the FPGA market is not large compared to GPUs, CPUs, MCUs, etc., but this "small and beautiful" market is very important.

For example, in the 5G market, due to the substantial increase in the number of 5G communication channels, especially the number of channels in massive MIMO is several to dozens of times higher than before, the FPGA usage of a single 5G base station has increased significantly. According to calculations, a 4G base station may only need 1-2 FPGAs, and a 5G base station needs 4-5 FPGAs. At the same time, the density of 5G base stations is about 1.5 times that of 4G base stations. Therefore, in the 5G era, the base station's demand for FPGAs is more than three times that of the 4G era.

In terms of AI, the industry has entered a substantive stage of implementation, and edge AI has become the focus of industrial development. As the integration of AI and edge terminals becomes closer and closer, the disadvantages of ASICs begin to appear. Under normal circumstances, the number of chips needs to reach more than 100,000 pieces, so that the development of ASIC can be valuable. But in the field of edge AI, most markets cannot reach this chip usage. This part of the demand has basically turned to FPGA. By programming FPGA, FPGA can perform any logic function that ASIC can perform, and there is no need to wait for the chip tape-out cycle of three months to one year.

At the same time, in a wide range of industrial fields, due to its flexible interface and programmable features, FPGA solves the complex needs of industrial AI for various interfaces such as CAN, PCIe, and JESD204, and improves the flexibility of industrial production. In the field of the Internet of Things, the concept of AIoT also brings a lot of FPGA demand.

Therefore, the definition of FPGA in the past industry is actually too narrow, resulting in the potential of FPGA cannot be fully released. Driven by 5G and AI, FPGA has ushered in a good era of rising volume and price. According to research data from Frost & Sullivan, it is estimated that by 2025, the global FPGA market will reach US$12.58 billion, nearly doubling compared to 2021.

The above are the confidence and reasons for AMD and Intel to raise prices.

Comclusion

As a programmable logic device, the capabilities of FPGA are increasingly recognized in the era of software-defined hardware, and gradually move towards more terminals. In this process, AMD and Intel currently hold the absolute right to speak. Even in the domestic market, domestic FPGAs basically do not pose too much threat to the two companies at present, because these two companies mainly focus on the high-end market.

To challenge the market leader, domestic FPGA manufacturers still have a long way to go. FPGA not only has challenges in device design, but also troubles in talent. Many people describe it as the most difficult track for domestic chips, but it is not It doesn't make sense.